Barran Press

A new initiative aimed at easing the escalating crisis between the internationally recognized Central Bank of Yemen in Aden and its branch in Sana'a, controlled by the Houthi group, was announced on Saturday, May 25th, 2024. The initiative, unveiled by the Economic Reform Team and reported by Barran Press, seeks to "reduce the currency split and establish a mechanism that includes positive engagement with the government's decision to relocate banks while preserving banks in Houthi-controlled areas and supporting their continued operation."

The initiative, presented during a virtual symposium organized by the Economic Media Center, addresses the negative repercussions of the currency split and explores pathways for de-escalation. It outlines specific criteria intended to "keep the banking sector out of the conflict, preventing further decisions and measures that would undermine it, leading to currency depreciation and exacerbating the humanitarian and economic crisis in Yemen."

Barran Press interviewed Mustafa Nasr, an economic expert and head of the Economic Media Center, to delve into the initiative's significance, effectiveness, and objectives. Nasr stated that the initiative "stems from a vision to defuse the current and escalating crisis between the two banks through positive engagement with the Central Bank's decisions in Aden." He emphasized that it simultaneously aims to "preserve local banks operating in areas controlled by the Houthi group, which is designated on global terrorism lists."

Nasr elaborated on the initiative's mechanism for achieving this, stating that it "will work to establish a settlement mechanism between the two banks based on precise criteria that will prevent further collapse and failure of the banking sector." He highlighted the grave consequences of the ongoing split, warning that its continuation would have "serious and catastrophic repercussions on the overall economic situation."

He emphasized that the initiative, "while attempting to reach a shared vision, will prioritize the interests of the banking sector and, most importantly, the interests of citizens." He asserted the impossibility of relocating banks within such a short timeframe.

Addressing the situation of the Central Bank in Aden, Nasr acknowledged the difficulty of its operation "without all banks and their branches being subject to its authority." He stressed that "it is in the best interest of banks to address the issue of their relationship with the banks in Aden and Sana'a. There must be a mechanism to agree on specific rules and criteria to establish a framework for interaction between the banks, serving the interests of the banking sector."

Nasr further explained that banks in Houthi-controlled areas "face a serious dilemma and a near-inevitable collapse." He asserted that the recent decisions of the Central Bank in Aden "have provided these banks with a lifeline to overcome this challenge, and this opportunity must be seized."

He highlighted that the proposed initiative "seeks to address this issue and find a formula for cooperation, ensuring neutrality and non-interference, whether through the issuance of unofficial currency denominations or through the adoption of decisions and laws that violate banking regulations and destroy the banking system in Yemen."

The Economic Media Center's symposium brought together economists, members of the Economic Reform Team, bank representatives, and academics. The discussions focused on establishing an independent dialogue between the Central Bank of Yemen in Aden and the Sana'a Bank to reach a solution that preserves what remains of the country's banking sector and prevents the looming collapse and bankruptcy of Yemen's banking institutions.

The Economic Reform Team is a voluntary initiative comprising a group of Yemeni business leaders and economic experts, aiming to empower the Yemeni private sector to contribute effectively and collectively to decision-making and participate in developing visions, strategies, and policies to stimulate economic reforms and growth in Yemen.

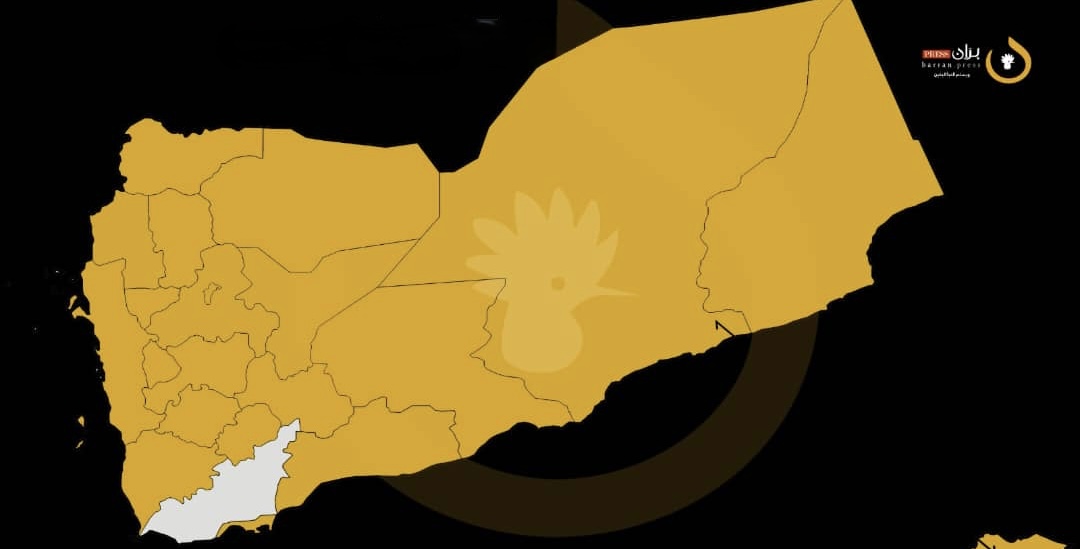

Yemen faces a severe currency crisis, with the local currency experiencing a significant decline against foreign currencies. The exchange rate in Aden and government-controlled areas reached a record low of 1706 riyals to the US dollar, compared to 1676 riyals in late April. The Saudi riyal also reached 449 riyals for sale, up from 441 riyals.

The Yemeni economy faces immense challenges due to the currency split imposed by the Houthi group, which is internationally designated as a terrorist organization. These challenges have intensified following the group's attacks on oil export ports in October 2023, preventing the internationally recognized Yemeni government from exporting oil.