Barran Press

A recent economic study, published on June 30th, 2024, argues that Yemen's economic woes are rooted in deeper issues than simply relocating bank headquarters, citing the halt of oil exports and the collapsing currency as key contributing factors.

The study, authored by economist and analyst Wahid Al-Foudai and published by the Yemen and Gulf Center for Studies, and seen by Barran Press, analyzed the economic and humanitarian impact of two decisions made by the Central Bank of Yemen in Aden, numbered 17 and 20 of 2024.

The study explained that decision 17, which "stipulated the relocation of bank operations centers to Aden, sparked significant ambiguity and misinterpretation, as it was perceived as a relocation of headquarters."

It pointed out that this "led to tensions between banks and the Central Bank in Aden, followed by sanctions imposed on some banks that were unable to implement the decision due to a lack of necessary support from the Central Bank of Yemen in Aden and the international community."

The study deemed the relocation of bank headquarters illegal and outside the Central Bank's jurisdiction.

It added that relocating banks falls under the purview of the banks' extraordinary general assembly and that the actual relocation of these headquarters is not feasible due to multiple obstacles and risks. In contrast, relocating operations centers is possible despite some risks and obstacles.

According to Al-Foudai, there is selectivity in decision 20 regarding the application of sanctions to six banks while others are spared, despite the unified stance of all banks, noting that this "exacerbates the economic and humanitarian crisis."

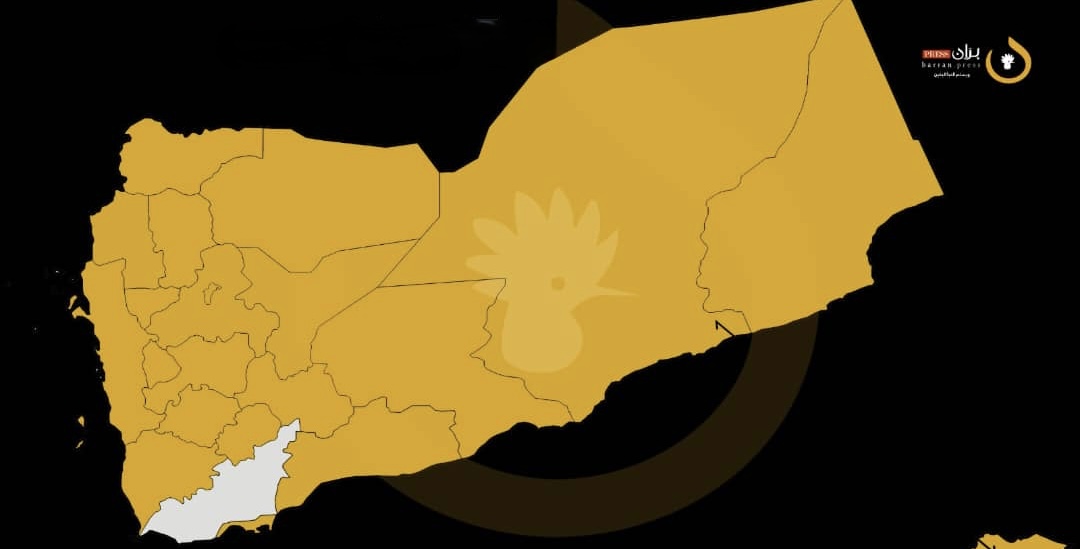

He emphasized that banks need support from the Central Bank in Aden instead of being penalized, stressing in the study that Yemen's economic problem has deep roots that go beyond the issue of relocating headquarters, such as the cessation of oil exports and the collapse of the exchange rate.

The study calls for a comprehensive strategy that includes international support and cooperation with local parties to liberate banks from Houthi control, and to assess the economic and humanitarian impact of decisions before they are made.

The study recommends strengthening transparency and clarity in the decisions of the Central Bank in Aden, focusing on the relocation of feasible operations centers instead of the impossible headquarters.

It highlights the importance of establishing a compliance and risk sector within the Central Bank, providing financial and technical support to banks, setting a sufficient timeframe for implementing decisions and improving communication and coordination channels between the Central Bank and banks.

The study suggests that the governor of the Central Bank in Aden should lead direct negotiations with banks to enhance the effectiveness of solutions, improve media handling, and explore less sensitive alternatives to banks to force the Houthis into peace.

It emphasizes the need to develop contingency plans to address unexpected challenges and ensure the continuity of banking operations while ensuring that decisions are fair and non-discriminatory to meet the expectations of citizens who support the decisions.

On May 30th, the Central Bank issued a decision to cease dealings with six Yemeni banks and financial institutions after the 60-day deadline for implementing its decision to relocate their headquarters to Aden expired.

It also issued another decision urging all individuals, commercial establishments, companies, other entities, and financial and banking institutions holding pre-2016 banknotes of various denominations to deposit them within a maximum period of 60 days from the date of the announcement.

The Central Bank, in a statement published on its official website, urged citizens, non-financial institutions, commercial establishments, and other entities that do not have accounts with the Central Bank to deposit their holdings of the specified banknotes in commercial and Islamic banks and their branches spread across liberated governorates.

It called on banks and financial and banking institutions that have accounts with the Central Bank to "deposit their holdings of the specified banknotes mentioned above with the Central Bank's main headquarters in Aden and its branches spread across various liberated governorates."

In its decision, the Central Bank urged "all financial and banking institutions and citizens holding amounts of these banknotes to respond promptly to this announcement to protect their funds and serve the public interest," emphasizing that it "will not bear any responsibility arising from the failure to seriously deal with the content of this announcement and to expedite the implementation of what is stated therein within the specified period."