Barran Press

The Yemeni Central Bank is preparing a "harsh" decision against commercial banks that have not complied with its instructions and decisions in areas controlled by the Houthi group, a designated terrorist organization by the international community, according to a source within the bank, reported by the London-based newspaper Asharq Al-Awsat on Monday, July 1, 2024.

The source said the decision "could be taken at any moment if the non-compliant banks in Houthi-controlled areas do not begin to take steps to respond and comply with its previous decisions."

The upcoming bank decision, according to the source, includes "withdrawing the SWIFT code from the non-compliant banks that reject its decisions, and permanently revoking their operating licenses, which will lead to the complete cessation of their activities outside of the Houthi group's control areas, turning them into small internal exchange offices incapable of providing any banking services to individuals, companies, and institutions."

The source clarified that "the Central Bank is still taking into account the interests of all depositors and clients of these banks and hopes that the previous decisions will be sufficient to demonstrate its seriousness in regulating the banking sector and controlling its operations and management in accordance with the law, in addition to its efforts to win over the banks to its side instead of the Houthi group using them."

The bank has continued its measures to tighten the financial noose on the Houthi group, a designated terrorist organization by the international community. On Friday, it revoked the licenses of three exchange companies and ordered the closure of their branches indefinitely for violating the bank's decisions and instructions.

This decision follows two previous decisions: imposing a unified network for domestic transfers, banning dealings with 12 unlicensed electronic payment entities, and permanently halting operations in local financial transfer networks owned by banks, exchange companies, or institutions operating in Yemen.

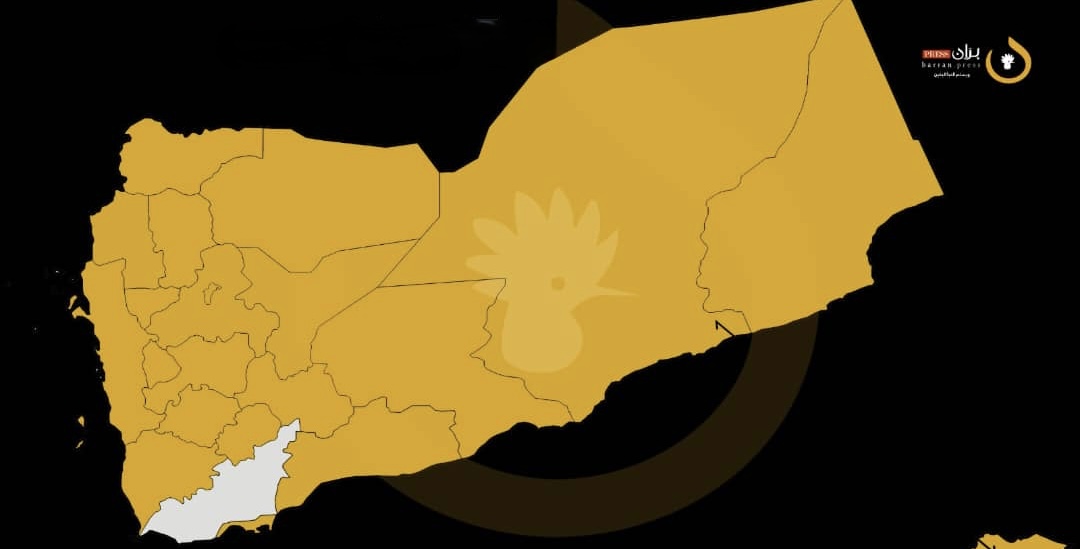

On May 30, the Yemeni Central Bank in Aden, the temporary capital of the country, issued a decision to suspend dealings with six Yemeni banks after the deadline of 60 days for them to implement its decision to relocate their headquarters to Aden expired.

The bank also issued another decision calling on all individuals, commercial establishments, companies, other entities, and financial and banking institutions holding pre-2016 banknotes of various denominations to deposit them within a maximum period of 60 days from the date of the announcement.