Six Yemeni banks sanctioned by the Central Bank of Yemen (CBY) in Aden, the country's temporary capital, have received official notification that their SWIFT access will be suspended within five days, according to informed banking sources.

The sources told "Barran Press" that the six banks received the notification from SWIFT, the global banking network, in Brussels, Belgium, on Thursday.

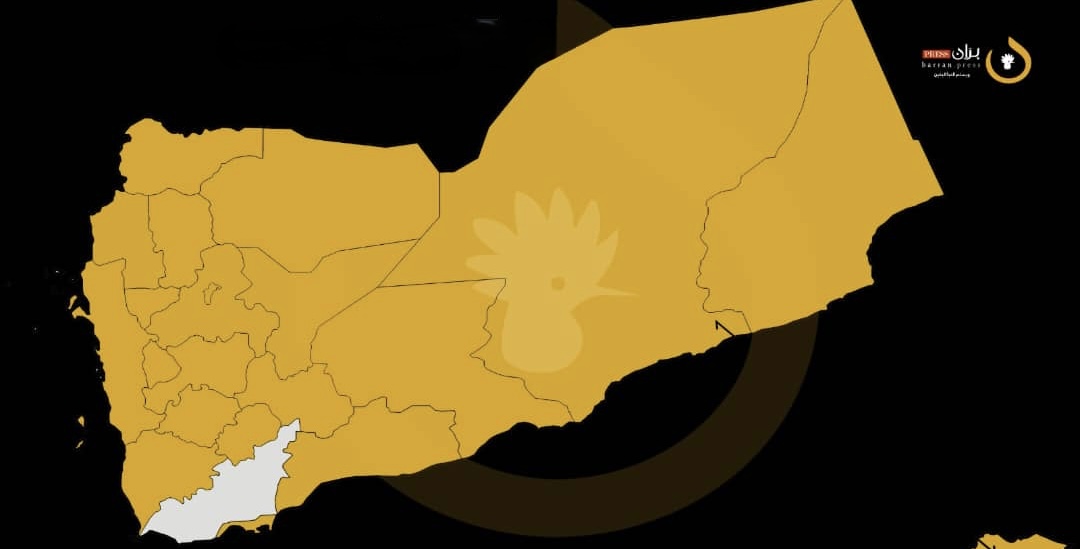

On July 9, the CBY in Aden revoked the licenses of six local banks, accusing them of failing to comply with the order to relocate their headquarters to Aden.

According to a leaked copy of the CBY's decision obtained by "Barran Press," the banks whose licenses were revoked are: Al-Kureimi Bank, Al-Tadhamun Bank, Yemen and Kuwait Bank, Al-Amal for Microfinance Bank, Yemen and Bahrain Comprehensive Bank, and Yemen International Bank.

The decision exempted branches of the violating banks located in areas under the control of the internationally recognized Yemeni government, allowing them to continue operating "until further notice."

On May 30, the CBY had issued a decision to suspend dealings with six Yemeni banks and financial institutions after a 60-day deadline for them to relocate their headquarters to Aden expired.

Simultaneously, the CBY issued another decision urging individuals, businesses, companies, and financial institutions holding pre-2016 banknotes of all denominations to deposit them within 60 days of the announcement.

The CBY has continued its measures to counter the economic measures taken by the Houthi group, designated as a terrorist organization by the UN, against the banking sector, which have cast a shadow over the economic situation and caused the Yemeni rial to decline in areas under government control.

These decisions come amid international pressure led by the United Nations to push the internationally recognized Yemeni government to back down from these measures, which have been described locally as decisive against the Houthis and could stop the group's manipulation of the exchange rate sector.

"Barran Press" obtained a letter from UN Envoy Hans Grundberg to the Presidential Leadership Council, in which he called for the postponement of the implementation of the recent CBY decisions related to the suspension of licenses for banks that failed to relocate their headquarters to Aden.

In the letter, Grundberg expressed concern about the CBY decision number 30 of 2024, which "suspends the licenses of six banks, and the subsequent communication with correspondent banks and the SWIFT system," stating that this "will lead to the cessation of access for these banks to correspondent banks and the SWIFT system."

The UN envoy urged the Yemeni government and the CBY to "postpone the implementation of the decisions at least until the end of August," calling for "the initiation of a dialogue under UN auspices between the Yemeni parties to discuss recent economic developments in Yemen."

Meanwhile, the Presidential Leadership Council held an "emergency meeting" to discuss Grundberg's letter, during which it "reaffirmed its commitment to a clear agenda for participation in any dialogue on the economic file," according to the official Yemeni news agency Saba.

The Leadership Council stipulated that for any dialogue on the economic file to proceed, "the resumption of oil exports, the unification of the national currency, the cancellation of all arbitrary measures against the banking sector and the business community" must be met.

In decisions issued by Governor Ahmed Al-Maabqi, the CBY last week revoked the licenses of 26 exchange companies since late last month, ordering the closure of their branches indefinitely for violating bank decisions and instructions.

These decisions followed two previous decisions, one imposing a unified network for domestic transfers and another prohibiting dealings with 12 unlicensed electronic payment entities, and the permanent cessation of operations in local money transfer networks owned by banks, financial institutions, or exchange companies operating in Yemen.