Barran Press

A recent economic study revealed that Yemen's budget has become heavily reliant on foreign aid, accounting for more than 30% of its total revenue. The report, published by the Yemeni Future Center for Strategic Studies, highlights that in 2014, foreign aid represented 43% of the country’s revenues.

The study, titled "Resource Deficit in Yemen: Exhausting Effects and Necessary Solutions," warns that the current conditions make it unlikely to address the existing resource gap. It predicts that the resource deficit will continue to widen, leading to further catastrophic consequences.

According to the report, reviewed by Barran Press, the resource shortages are a direct result of the ongoing war in Yemen, which has persisted since the conflict's onset. The economic and social impacts are described as "catastrophic," resulting in the collapse of essential services, halted development efforts, currency devaluation, and rising poverty and unemployment rates.

The study notes a significant increase in the trade deficit since the war began, with the gap between imports and exports widening drastically due to the cessation of oil and gas exports and the shutdown of various production activities.

To address these challenges, the report recommends the urgent resumption of oil and gas exports to mitigate the budget deficit without relying on foreign aid, stating this would provide essential resources for development programs.

In addition, the study advocates for mobilizing financial resources through clear and structured plans within official channels, particularly through the Central Bank of Yemen in Aden. It also calls for combating financial and administrative corruption.

The report suggests implementing austerity measures, such as reducing the number of diplomatic missions abroad, cutting staff in embassies, and halting unnecessary government travel and purchases.

Furthermore, it emphasizes the need to stop energy purchases while allowing the private sector direct access to the energy market, which could save the state approximately 15% of its total spending.

The economic study also urges the discontinuation of salary payments in foreign currency, converting them to local currency, and halting unlawful appointments and excessive consultancy roles.

It calls for the establishment of an annual government budget based on sound financial management principles and the development of reconstruction and economic recovery plans to address the adverse effects of resource deficits on the economy and citizens.

To tackle the current account deficit, the report suggests attracting investment from Yemenis abroad and adjusting legislation to lure foreign investment, alongside restarting refineries in Aden and expanding new facilities in Shabwa and Hadramaut based on approved feasibility studies. It also proposes a temporary ban on luxury goods and vehicle imports.

The study highlights the need to encourage the private sector to restore operational levels to those seen in 2015 and to stimulate investments in productive sectors, especially in goods that replace imports.

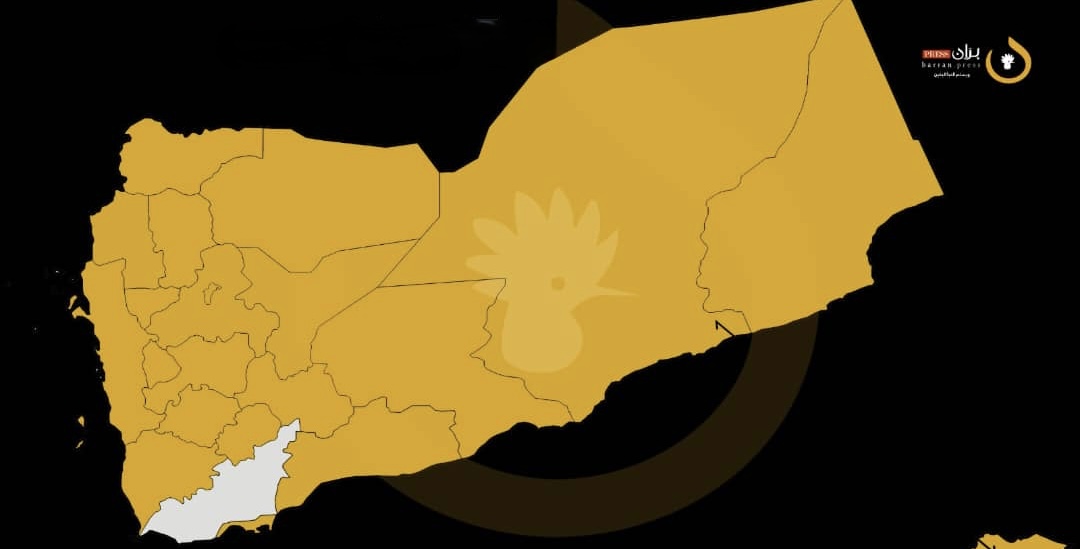

Yemen continues to face a severe financial crisis due to the ongoing effects of the war since the Houthi takeover of the capital and various provinces in late 2014. The situation worsened after oil exports ceased in October 2022 due to Houthi attacks on export ports.

The Houthis have refused to allow the resumption of oil exports unless an agreement is reached to pay public sector salaries from oil revenues across all regions of Yemen.

Currently, the internationally recognized Yemeni government is grappling with a severe cash crisis, with the local currency experiencing significant instability. The exchange rate has reached an all-time low, with one dollar now costing 2,060 riyals, compared to 1,676 riyals in late April.

In July, the UN Special Envoy for Yemen, Hans Grundberg, announced an agreement between the Yemeni government and the Houthis to implement several measures aimed at reducing tensions in the banking sector and Yemenia Airways.

The agreement included the cancellation of recent banking decisions and an increase in Yemenia's flights between Sana'a and Jordan.

On November 7, 2024, the Yemeni government held an extensive discussion to evaluate an economic rescue plan that aligns with its priorities of restoring state authority and achieving peace.

The government approved the formation of a ministerial committee to study the plan and incorporate feedback, aiming to develop a unified economic document to guide state operations.

A World Bank report released on October 31, 2024, emphasized that Yemen's economy continues to face escalating challenges due to prolonged conflict, political fragmentation, and rising regional tensions, pushing the country towards a deeper humanitarian and economic crisis.

The report indicated that the halt in oil exports, coupled with heavy reliance on imports, has intensified external pressures, leading to an unprecedented decline in the Yemeni rial's value.

It noted that the ongoing economic fragmentation between Houthi-controlled areas and those under the internationally recognized government, along with disparities in inflation rates and exchange values, have undermined stability and recovery efforts.

The report also highlighted potential risks for Yemen's banking sector amid rising tensions between the Houthis and the recognized government over regulatory oversight.

The World Bank forecasts a contraction of Yemen's GDP by 1% in 2024, continuing a downward trend after a 2% decline in 2023, which would further deteriorate the per capita real GDP by 54% since 2015.