Barran Press

A recent research study has shed light on the reasons behind the Presidential Leadership Council's (PLC) provisional agreement to postpone the Central Bank of Yemen's (CBY) decision to revoke licenses of non-compliant banks. The study, published by the Mukha Center for Strategic Studies and reviewed by Barran Press, also explores the potential scenarios stemming from this move, which has sparked widespread anger among the Yemeni public.

The study delves into the escalating economic conflict between the internationally recognized Yemeni government and the Houthi group, designated as a terrorist organization by several countries. It highlights the growing role of economic tools in the ongoing war between the two factions since 2014.

According to the study, economic tools have become a central focus of the conflict, particularly after the Houthis prevented the Yemeni government from exporting oil in October 2022. This influence has intensified during the fragile truce that began in April 2022, further exacerbated by the Houthis' issuance of a new currency (100 rial coin) to replace damaged banknotes.

The study further emphasizes the heightened economic entanglement following the CBY's recent decision in Aden to revoke the licenses of six banks for failing to relocate their headquarters to Aden and the subsequent notification to the SWIFT system to halt transactions with these banks.

The study asserts that this decision prompted the Houthis to threaten Saudi Arabia with military escalation, leading the UN envoy to intervene and demand the postponement of these decisions until the end of August.

Despite overwhelming public support for the CBY's decisions, the PLC faces significant pressure from the UN envoy to halt these measures, according to the study.

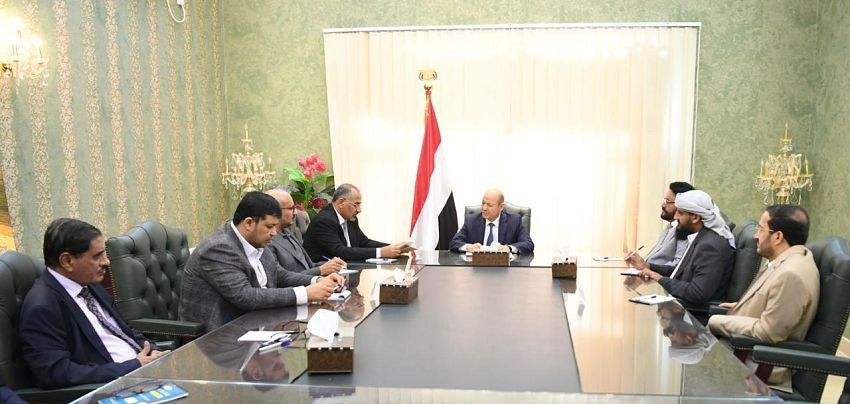

Under this pressure, the study reveals that the PLC convened an emergency meeting on July 12th, where it expressed its provisional agreement to engage in economic negotiations under specific conditions, including the resumption of oil exports and the unification of the national currency.

Despite emphasizing the need to deter Houthi practices, this meeting was widely interpreted as an acceptance of the UN envoy's request to postpone the implementation of the CBY's decisions, according to the study.

The study identifies three key reasons behind the PLC's conditional agreement to the UN envoy's request:

- Saudi pressure: The study suggests that Saudi Arabia exerted pressure on the PLC to postpone the implementation of the decisions.

- Implementation challenges: The study highlights the complexities involved in revoking the licenses of the six banks and preventing their access to the SWIFT system, making implementation a highly intricate task.

- Avoiding escalation: Despite the PLC's assertion of its commitment to deterring the Houthi group's arbitrary practices, the PLC's decision was widely understood as an attempt to avoid escalation that could lead to military conflict, as warned by the UN envoy.

The study outlines three potential scenarios for the future trajectory of this situation:

- Continued economic conflict: The first scenario envisions the continuation of economic conflict without the legitimate authority being able to enforce the CBY's recent decisions.

- Negotiated resolution: The second scenario anticipates successful regional and international efforts to push both parties towards negotiations leading to solutions that mitigate the economic conflict.

- Escalating conflict: The third scenario predicts an escalation of the economic conflict, potentially leading to military confrontation between the two sides. Despite the reluctance of most parties to engage in another round of war due to its high cost and potential for losses, the threat of war could still be used as a tool for blackmail, pressure, or deterrence.

On July 20th, 2024, a source within the CBY in Aden, declared as the temporary capital of Yemen, revealed that the CBY governor, Ahmed Ghalib Al-Ma'bqi, remains steadfast in his recent decisions and refuses to back down despite mounting pressure.

The source talked to "Barran Press", and requested anonymity due to lack of authorization to speak to the media, confirming that significant pressure is being exerted on Al-Ma'bqi to retract the CBY's recent decisions aimed at regaining control over the banking sector.

The source emphasized Al-Ma'bqi's rejection of all pressure and his determination to proceed with the implementation of these decisions. He also indicated that the governor is currently in Riyadh, Saudi Arabia, to discuss the next steps with the PLC regarding the implementation of the CBY's decisions and the international call for their postponement.

The source further revealed that the recent step of imposing sanctions on the six banks subject to CBY sanctions, including notifying them of the suspension of their SWIFT access within five days, was taken by Al-Ma'bqi without consulting the PLC.

On July 18th, informed banking sources told Barran Press that the six Yemeni banks subject to CBY sanctions received "an official message informing them of the suspension of their SWIFT access within five days" from SWIFT in Brussels, Belgium, which provides banking system services to various countries worldwide.

On July 9th, 2024, the CBY in Aden revoked the licenses of six local banks, citing their failure to comply with the decision to relocate their headquarters to Aden.

According to a leaked copy of the CBY's decision obtained by Barran Press, the banks whose licenses were revoked are: Al-Kureimi Bank, Al-Tadhamun Bank, Yemen and Kuwait Bank, Amal Bank for Microfinance, Yemen and Bahrain Comprehensive Bank, and Yemen International Bank.

The decision exempted branches of the non-compliant banks located in areas under the control of the internationally recognized Yemeni government, allowing these branches to continue operating "until further notice."

On May 30th, the CBY issued a decision to halt transactions with six Yemeni banks and financial institutions after the 60-day deadline for implementing its decision to relocate their headquarters to Aden expired.

Simultaneously, the CBY issued another decision urging all individuals, businesses, companies, other entities, and financial and banking institutions holding banknotes from the old printing before 2016, of all denominations, to deposit them within a maximum period of 60 days from the date of the announcement.

The CBY continued its measures to counter the economic measures taken by the Houthi group, designated as a terrorist organization by several countries, against the banking sector, which has cast a shadow over the economic situation and led to a decline in the value of the Yemeni rial in areas under government control.

Through decisions issued by Governor Al-Ma'bqi, the CBY revoked the licenses of 26 exchange companies since late last month, ordering the closure of their branches indefinitely for violating CBY decisions and instructions.

These decisions followed two previous decisions to impose a unified network for domestic transfers, prohibit transactions with 12 unlicensed electronic payment entities, and permanently halt operations in local money transfer networks owned by banks, financial institutions, or exchange companies operating in Yemen.