Barran Press

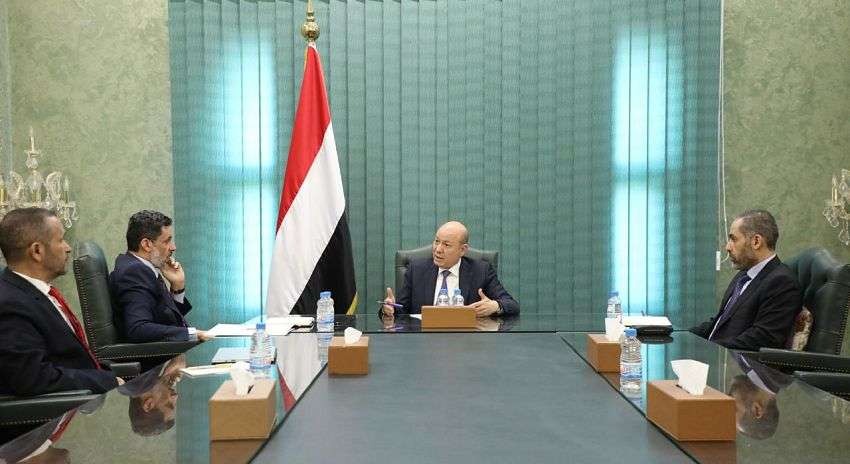

An economic meeting chaired by Rashad Alimi, President of the Presidential Leadership Council, was held on Sunday to expedite the implementation of a "rescue plan" aimed at curbing currency speculation and enhancing regulatory measures to support the independence of the Central Bank of Yemen.

The meeting took place at the Maasheeq Palace in Aden, the temporary capital of Yemen, and included Prime Minister Ahmed Awad bin Mubarak, Economic Team Leader Hossam Al-Sharjabi, and Deputy Team Leader Othman Al-Hadi, as reported by the official Yemeni news agency Saba.

The agenda focused on recent developments in Yemen’s economic, financial, and monetary situation, discussing coordinated measures to combat inflation and strengthen the national currency.

During the meeting, Prime Minister bin Mubarak provided an update on the economic and financial landscape, proposing interventions to improve the national currency's position and mitigate the adverse effects of price fluctuations on living conditions and services.

The discussion emphasized a series of necessary measures to address the budget deficit, deter currency speculators, rationalize import costs, control the money supply, and activate regulatory enforcement to uphold the Central Bank's independence in managing the banking sector.

Alimi stressed the urgency of executing the economic rescue plan and addressing the monetary division imposed by the Houthi group, which is internationally recognized as a terrorist organization and supported by the Iranian regime.

He praised Saudi Arabia, the UAE, and regional and international partners for their role in supporting the government's efforts to fulfill its obligations, particularly in paying salaries, securing essential goods, and providing basic services for millions of Yemenis across the country.

Earlier on the same day, Alimi convened an emergency meeting with the High-Security Committee to discuss supporting the Central Bank in managing monetary policy and implementing measures to protect the national currency.

According to Saba, the focus of this meeting was on enhancing the High-Security Committee's role in supporting the Central Bank's efforts to stabilize the currency market and combat speculation and black market activities that harm the national economy and living conditions.

The Yemeni government is currently grappling with a severe currency crisis, with the rial reaching its lowest exchange rate against foreign currencies. The dollar has surpassed 2,000 rials in Aden and other government-controlled areas, compared to 1,676 rials in late April. Meanwhile, the Saudi riyal is trading at 524 rials for sale, up from 441 rials.

This represents the lowest level the national currency has recorded against foreign currencies in government-controlled areas while remaining stable in Houthi-controlled regions at 538 rials per dollar for sale and 534 rials for purchase.

Last week, the Central Bank's board urged the Yemeni government to reconsider its financial and economic policies, especially in resource mobilization and expenditure planning.

During its ninth session held via video conference, the Central Bank called on the Presidential Leadership Council and the government to support the bank in fulfilling its responsibilities with independence and professionalism amid the challenging circumstances and unfavorable developments.